Once upon a time, MySpace was the king and pioneer of social networking. When Rupert Murdoch's News Corp. bought the company for $580 million, it looked like a steal. Surely MySpace must be worth billions as it forged a path into whole new corners of the Internet and popular culture. Right?

But oh, how far the mighty have fallen. Today News Corp. sold MySpace to Specific Media—an advertising specialist you've never heard of—for a mere $35 million. Many MySpace employees are out of a job, and pretty much all of them will be gone soon enough, according to AllThingsD and the New York Times. Exactly what Specific Media hopes to gain from this empty shell isn't clear, though the MySpace site remains functional (under some creative definitions of the word "functional") and the brand name just might be worth something in the right hands.

When Murdoch bought MySpace, it was a vibrant and thriving online society hell-bent for world domination. Looking in the rearview mirror, Facebook was coming up fast, but still entirely focused on college campuses. Then Facebook blew the doors wide open and invited everyone to the party, with a tasty menu of chatting, gaming, and sharing all wrapped up in a consistent, elegant interface. The eclectic MySpace never stood a chance. Now we get the final bill for the damage done.

Doing the math

So what's the real damage to News Corp. from this botched online venture? Just subtracting the sale price from the original price tag and calling it a $545 million short-sale doesn't do it justice, because then you're ignoring the puts and takes of running the darn business. In fact, the whole process of figuring out the numbers is tricky because News Corp. and MySpace never talked about them. That's hardly unusual, as we still don't really know what kind of business YouTube pulls in for Google, for example, but it's annoying when you're trying to figure things out. So there's some guesswork involved.

Let's start by figuring out the initial situation. Intermix Media, the original parent of MySpace, made a net profit of $1.5 million in the twelve months leading up to the News deal. $37 million of its $88.9 million in total revenue came from the Network division, chiefly home to MySpace. The rest fell in from direct and online marketing of high-margin merchandise such as beauty products and inkjet cartridges. The e-commerce stuff quickly disappeared in the vast News machine, and I think it's fair to write it off as a discontinued operation from the start. The old Alena brand was mentioned in the exhaustive list of subsidiaries in the 10-K filing of 2006, but was gone the next year.

In 2006, the company happily highlighted that MySpace averaged 29 billion monthly page views in the US alone, boasting over 90 million registered users. But News never bothered to break out MySpace results, or even the larger Fox Interactive Meda operation of which it was a part, from the "Other" segment in its financial reports.

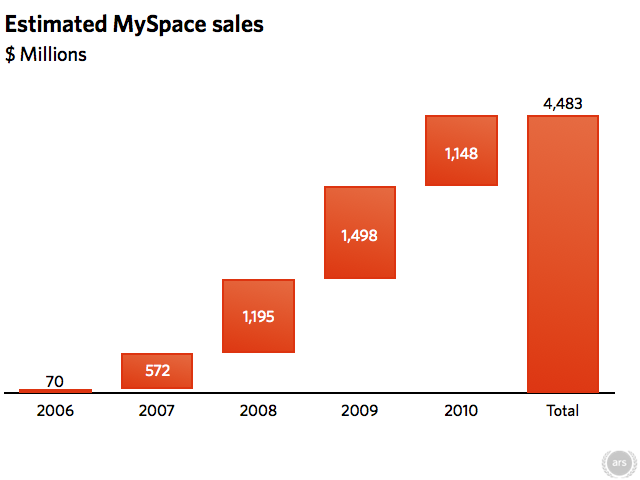

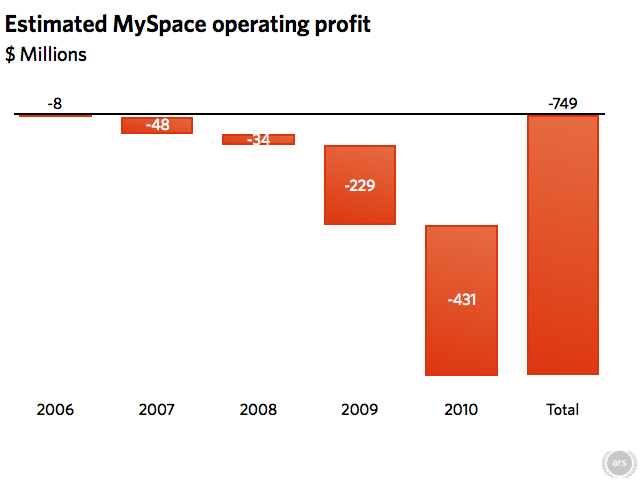

But traffic doubled in the first year, and MySpace was, as already discussed, mildly profitable at first. So let's say that sales in 2006 landed at about $70 million with a breakeven bottom line. From there, News Corp COO Chase Carey said that the bulk of that Other segment consisted of MySpace in 2010. By then, the division accounted for $1,5 billion in annual sales and a $575 million operating loss. (Ouch.) "Other" sales peaked in 2008, and never saw a profitable fiscal year in the MySpace era.

So if we start with about $70 million of MySpace revenue in 2006 and guess that "the bulk" might translate into something like 75 percent of the Other division, we can construct an overly simplistic yet instructive model of how it all worked out.

In this scenario, MySpace sales peaked in 2009 at something like $1.5 billion (out of $2.4 billion for the whole business segment). Operating losses start climbing right away, landing at $431 million in 2010 and adding up to $750 million. That tally stops in June of 2010, because News doesn't report segment results more than once a year. The next full-year report is two-and-a-half months away today.

Endgame

So all things considered, MySpace has cost Murdoch's empire something like $1.3 billion. Even if my assumptions are way off, the final cost can't be less than $1 billion. That fiasco isn't putting Murdoch out of business: News Corp turned a $2.9 billion dollar profit in the last four quarters and generated $2.2 billion in free cash flow, for example. But it still stings as Murdoch's dreams of an end-to-end interactive media empire falls apart. And his shareholders have been trailing the broader market as well as rivals Viacom and Disney over those five painful years.

And now hated rival Facebook is getting ready to hit the stock market with a valuation perhaps topping $100 billion. That's hardly a camera finish in the race to dominate social networking.

reader comments

81