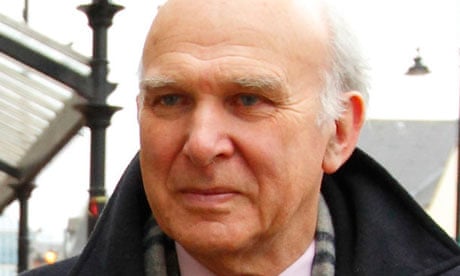

The business secretary, Vince Cable, has dismissed the loss of Britain's triple-A credit rating as "largely symbolic", while two former Conservative chancellors have offered support to the beleaguered George Osborne.

With financial markets braced for sterling to fall when the City returns to work on Monday, Cable attempted to shrug off Moody's decision to downgrade the UK to AA1 from AAA on Friday night.

"In terms of the real economy, there is no reason why the downgrade should have any impact," Cable told BBC1's Andrew Marr Show. "These things do not necessarily affect the real economy, but they do reflect the fact that we are going through a very difficult time."

Cable pointed out that rating agencies – whom he dismissed as "tipsters" at one point – had also downgraded the US and France recently without causing panic, and he dismissed suggestions that the government should change its economic course. "There are some positive things happening," he insisted, pointing to recent employment data.

But Osborne's predecessor, Alistair Darling, argued that Moody's move should be a wakeup call for the UK.

"We're absolutely stuck. There's been no growth for the last two years," Darling told Sky News. He argued that the government's inexperience and "perhaps a touch of recklessness" had led Osborne to repeatedly cite the UK's credit rating as such an important yardstick.

"I'm sure he [Osborne] will reflect on whether it was wise to go on about the triple-A rating so much," Darling said.

Darling's argument that Osborne should rethink his strategy was dismissed by two other previous inhabitants of No 11.

Lord Lawson said it was vital that Osborne reassured the financial markets that he was committed to his deficit reduction strategy. "Standing firm is a pretty good policy at the present time," Lawson said.

Ken Clarke predicted it would take "several more years" before Britain recovered its triple-A rating with Moody's and returned to solid economic growth.

"People have far more confidence in Britain than in many other western countries who have got into trouble through profligate economic policies," he said.

Some City experts fear the pound could tumble on Monday, when investors get their first chance to respond to Moody's downgrade. Gilts, or UK sovereign debt, could also be hit, pushing up Britain's cost of borrowing.

However, a full-blown panic is not expected.

"It will be interesting to see how investors react," said Paul Griffiths, co-global head of fixed income at Aberdeen Asset Management.

"The immediate concern is likely to be a further weakening of the pound, which has already had a move lower in the first few weeks of this year.

"This will be immediately beneficial for our experts, but the medium-term risk is this sees inflation imported with the rising cost of goods and services from abroad," Griffiths explained.

Howard Archer, chief UK economist at IHS Global Insight, agreed that the pound was "particularly vulnerable", having already fallen almost 7% against the US dollar since the start of the year.