Rackspace off to 'slow start' for 2013 with Q1 revenue miss

Despite professed optimism from company executives, Rackspace is starting 2013 off on the wrong foot by dipping below analyst expectations.

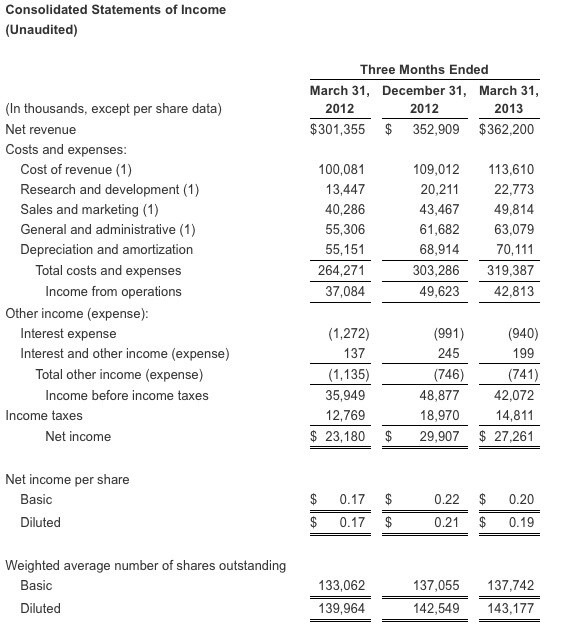

The open cloud company reported first quarter earnings of $27 million, or 19 cents a share (statement). Non-GAAP earnings were 20 cents a share on a revenue of $362 million.

That's up 2.6 percent from the previous quarter and 20 percent better from the first quarter of 2012.

But Wall Street was expecting Rackspace to report first quarter earnings of 19 cents a share on revenue of $366.7 million.

Rackspace chief financial officer Karl Pichler reflected on the revenue miss in prepared remarks:

We got off to a slow start for the year. Building a lasting, successful business is our number one priority. However, our immediate focus is on restoring our growth trajectory. We are excited to see the industry momentum behind OpenStack and we are determined to claim the service leadership position in the Open Cloud movement.

CEO Lanham Napier added in the Q1 report, "We are optimistic about our long-term position in the market and our future opportunity as the world moves to a new model of computing."

Rackspace attributed the miss to "currency exchange rates when compared to the previous quarter."

For the second quarter, Wall Street is looking for Rackspace to report 21 cents a share on $383.86 million.

Here are more highlights from Rackspace's Q1:

- Total server count increased to 94,122, up from 90,524 servers at the end of the previous quarter.

- Rackspace had 5,043 employees worldwide as of March 31, up from 4,852 in the previous quarter.

- Acquisitions during the quarter: Exceptional Cloud Services and ObjectRocket. Both push Rackspace further into the MongoDB market.

Chart via Rackspace Investor Relations