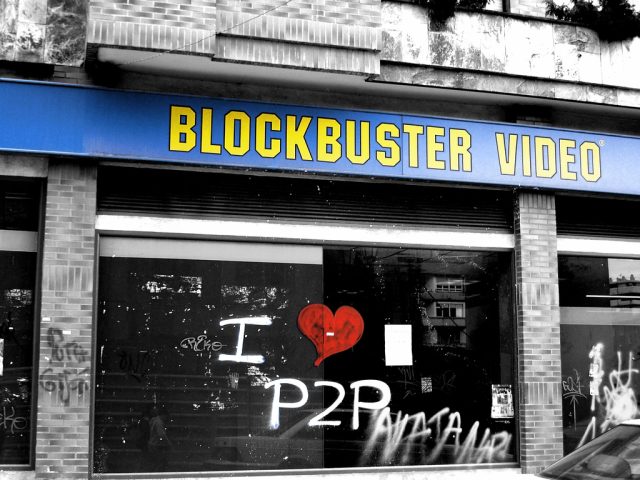

Growing up, Blockbuster was the place to go to get videos. When I was a kid, we’d drive down to the now-shuttered big, bright corner store in Santa Monica to pick out movies to watch. Later, in college, I patronized Berkeley’s local indie shop Reel Video (also now defunct) on the rare occasions that I wanted to rent something. But by my junior year in college (2003), I—along with millions of Americans—discovered Netflix, and happily devoured as many films as I could.

In other words, I pretty much haven’t thought about Blockbuster in well over a decade—and yet, the tenacious company is still out there. (There’s one just around the corner from me in Oakland!) Oh, how the mighty have fallen.

It was just a year ago that Blockbuster announced it would be offering a mailed DVD and streaming movie service (yes, à la Netflix) as a way to go head-to-head with the California company that has re-defined how we consume TV and movies.

But this week, Dish Network (Blockbuster’s parent company) CEO Charlie Ergen said the company is now giving up on that strategy.

Blockbuster lost $13 million last quarter

When Blockbuster declared bankruptcy in 2010, Dish Network swooped in within a year to acquire the video rental chain for $320 million. The plan was that by using the footprint of those stores, Dish could sell mobile devices to stream Blockbuster movies. But the Federal Communications Commission has been taking longer than expected in deciding whether Dish should be allowed to use its satellite spectrum for that purpose.

“You make a lot of mistakes in business,” Ergen, Dish’s founder and chairman, told Bloomberg, in an Oct. 3 interview. “I don’t think Blockbuster is going to be a mistake, but it’s unclear if that’s going to be a transformative decision.”

In the company’s most recent earnings report, Dish reported that Blockbuster lost $13 million in the second quarter of 2012, a loss that was attributed to “a result of lower monthly revenue and higher inventory costs per unit relative to the fair value of the inventory costs per unit acquired in the Blockbuster Acquisition.”

In short, Blockbuster isn’t making money. (Surprise!) To add insult to injury, Dish is also currently facing three patent infringement lawsuits against Blockbuster.

The slow, decade-long decline

Long before the bankruptcy, Blockbuster had been struggling to regain its footing. It launched its own Netflix-style clone in 2004. It got hit with a lawsuit by Netflix in 2006 (they settled a year later). More recently, Redbox and Verizon teamed up to go against the big yellow giant.

Dish has already begun closing stores—the company says it still has around 900 stores, which is of course a far cry from the 9,000 stores the company had in 2004. So, as a result of the federal regulatory delay, Ergen told Bloomberg that he’s reconsidering that entire plan.

“When your lease runs out on the stores, you can’t re-up because you can’t make enough money from just selling DVDs,” Ergen said.

The founder also said that buying Blockbuster was originally not very risky. The worst-case plan, he said, was to simply liquidate the company. When Blockbuster was acquired, it had $100 million on hand, and 1,700 stores. Selling the whole lot, Dish estimated, would yield about $300 million.

“There was very little risk in buying,” Ergen said. “Worst case we break even or make a little bit of money.”

Whether that plan—in late 2012—is still viable, is another question. Meanwhile, I’ve moved on to Hulu and iTunes.

reader comments

102