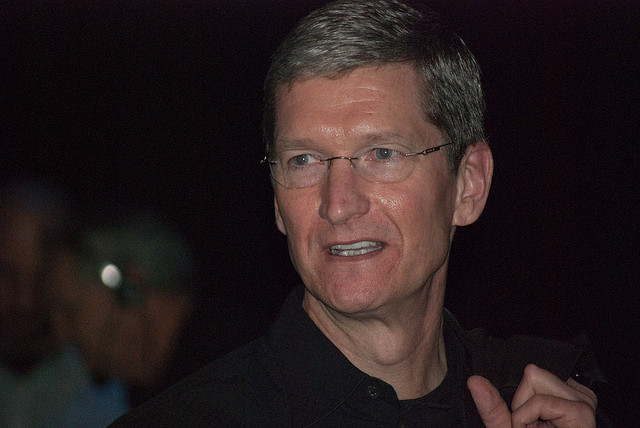

Unlike his predecessor, Apple CEO Tim Cook doesn't appear reluctant to face down a Senate subcommittee. He's due to appear in Washington DC next week to testify at a Senate hearing on offshore profit shifting and he plans to directly address the concerns Congress is raising:

The Subcommittee will continue its examination of the structures and methods employed by multinational corporations to shift profits offshore and how such activities are affected by the Internal Revenue Code and related regulations. Witnesses will include representatives from the Department of the Treasury, the Internal Revenue Service, representatives of a multinational corporation, and tax experts.

The roles of "representatives of a multinational corporation" will be filled by Cook along with Apple CFO Peter Oppenheimer and Apple Head of Tax Operations Phillip Bullock.

The Senate subcommittee will be grilling Apple on exactly why the company keeps more than $100 billion of its infamous cash hoard in non-US banks. The accusatory undertone is that Apple is engaging in what the subcommittee will almost certainly characterize as tax avoidance (and Apple's issuing of bonds last month to generate additional cash certainly isn't going to help). But in a string of preemptive interviews with publications various and sundry, including the Washington Post and Politico, Cook appears unconcerned. Instead it sounds like he is viewing the congressional summons as a teaching opportunity.

"You may not know this, but Apple likely is the largest corporate taxpayer in the US," Cook told the Washington Post. "When you combine state and federal, Apple is paying approximately $1 million an hour in just domestic income taxes."

Cook says he plans to discuss the impact Apple has on the US economy both in terms of tax dollars paid and in less-direct ways, such as the $9 billion in royalty payments it has made from its app stores to iOS and OS X developers. Half of that payout occurred within the past 12 months.

Congress on the other hand doesn't appear ready to give Cook an easy time. The subcommittee will be chaired by Sen. Carl Levin (D-MI) who has in the past slammed the US's tech industry for allegedly failing to pay its fair share of taxes; also on the committee will be Sen. Tom Coburn (R-OK), who has described himself as "livid" at Apple's tax-related behavior.

As is the case with most hearings like this the session will likely be long on rhetoric and short on action. Corporate taxation is a prickly subject and one on which just about everyone has an opinion. Indeed, just across the pond in the UK, Amazon and Google are finding themselves answering somewhat similar questions from the British government. How much tax to pay, and what "fair" means, and what the difference is between smart accounting and "tax avoidance," remain contentious questions.

reader comments

153